US Manufacturing & the Debt Ceiling

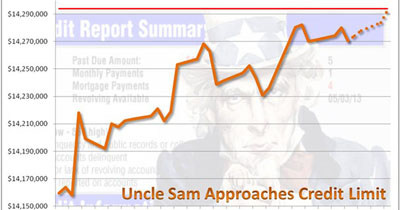

On August 2, 2011 the United States is going to hit its debt ceiling of 14.3 Trillion dollars. However, there has been a good amount of political posturing in the Legislative Branch on a compromise of the spending cuts and revenue increases before the House of Representatives and Senate will pass an increase to the US debt limit. Without raising the US debt ceiling, the US would have to default on some of its obligations for the first time in history.

Treasury Secretary Timothy Geithner wrote: “A default would inflict catastrophic, far-reaching damage on our nation’s economy, significantly reducing growth and increasing unemployment.”

The National Association of Manufacturers sent Congressional leaders a letter urging action to raise the federal debt limit.

The letter stated, "With economic growth slowly picking up we cannot afford to jeopardize that growth with the massive spike in borrowing costs that would result if we defaulted on our obligations."

LORD Corporation, a US Manufacturer said, “America cannot afford to renege on its commitments, and LORD would not be in a position to add jobs if our country were to default on its loans. Assuming that there is a last-minute deal to raise the debt limit and avoid default, the terms of this deal will also have a direct impact on our ability to add jobs and remain competitive in the future.”

Larry Sloan, president of the Society of Chemical Manufacturers and Affiliates (SOCMA) stated “A less than stellar credit rating on our sovereign debt will trickle down to higher interest rates on everything from capital improvement loans to revolving credit."

As a consequence, chemical companies and other industrial firms that depend on outside funding for capital improvements or major equipment purchases “could feel the brunt. Among other consequences, a US default or even a credit rating downgrade would put downward pressure on the US dollar.

That might make US exports more competitive in foreign markets, Sloan noted, but it also would increase the cost of US imports, including for raw materials that many US chemical companies need.

“The cost of raw material imports could far outpace any export boost resulting from a cheaper dollar, and profitability would suffer,” Sloan said.

Not raising the US debt ceiling would harm US Manufacturing, which has been leading the US Recovery out of the Great Recession.

Thanks,

Ben Moore

President

Agent Technologies, Inc.